Buy/Sell Value: Mergers & Acquisitions

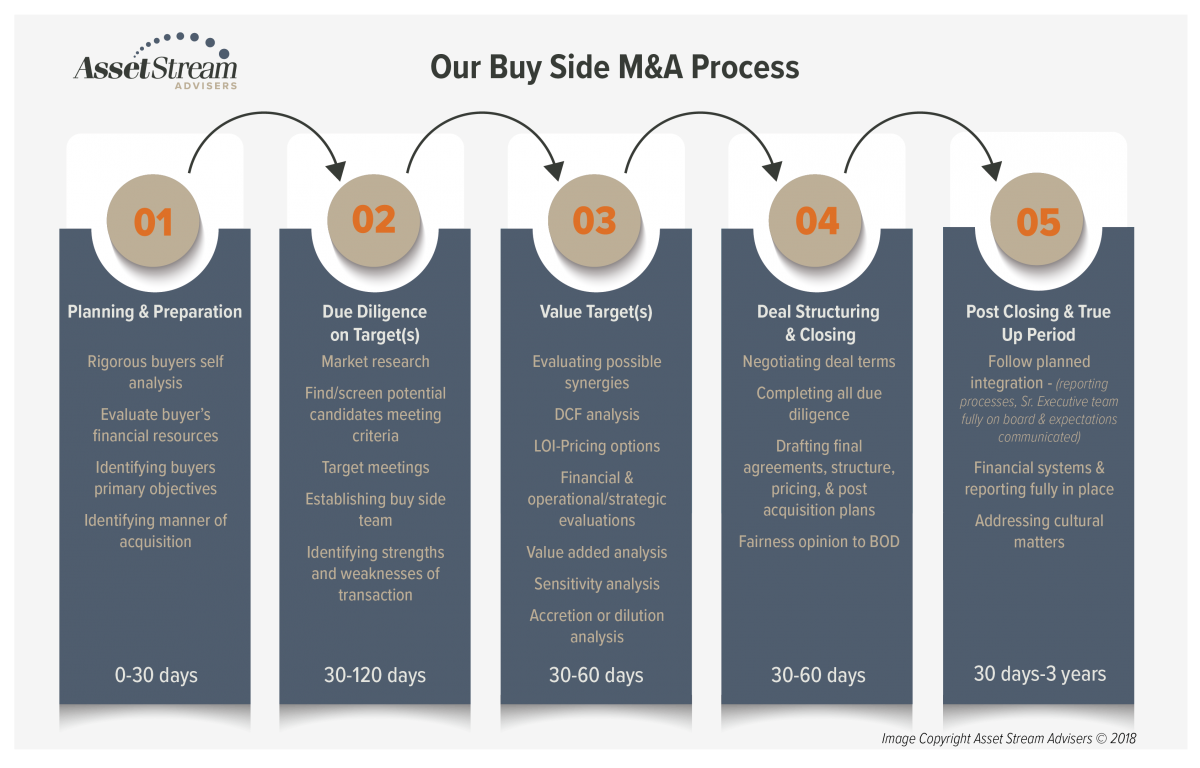

Buy Side Representation

Our team, led by Bob, has extensive experience representing both individuals and businesses on the buy side of the deal. Working with senior management, we will help you identify strategic companies and assets with the potential to deliver the highest return on investment for your organization. These networks allow us to represent either an investor or a seller to highly specific industry market spaces so we can align our work in locating strategic fits for your operations. One of our biggest priorities is achieving agreement across all department heads as to need, industry segment, funding levels, timetables, and more.

We stand out because of our unique background working with diverse Alaskan businesses including Alaska Native Corporations (ANCs). In the last 20 years, Bob has traveled to more than 50 native villages and worked directly with village counsels as well as the corporate boards. He has worked on a number of deals with strong cash buyers for ANCs and knows how to navigate the complex systems in place for effective negotiations and to close the deal.

—

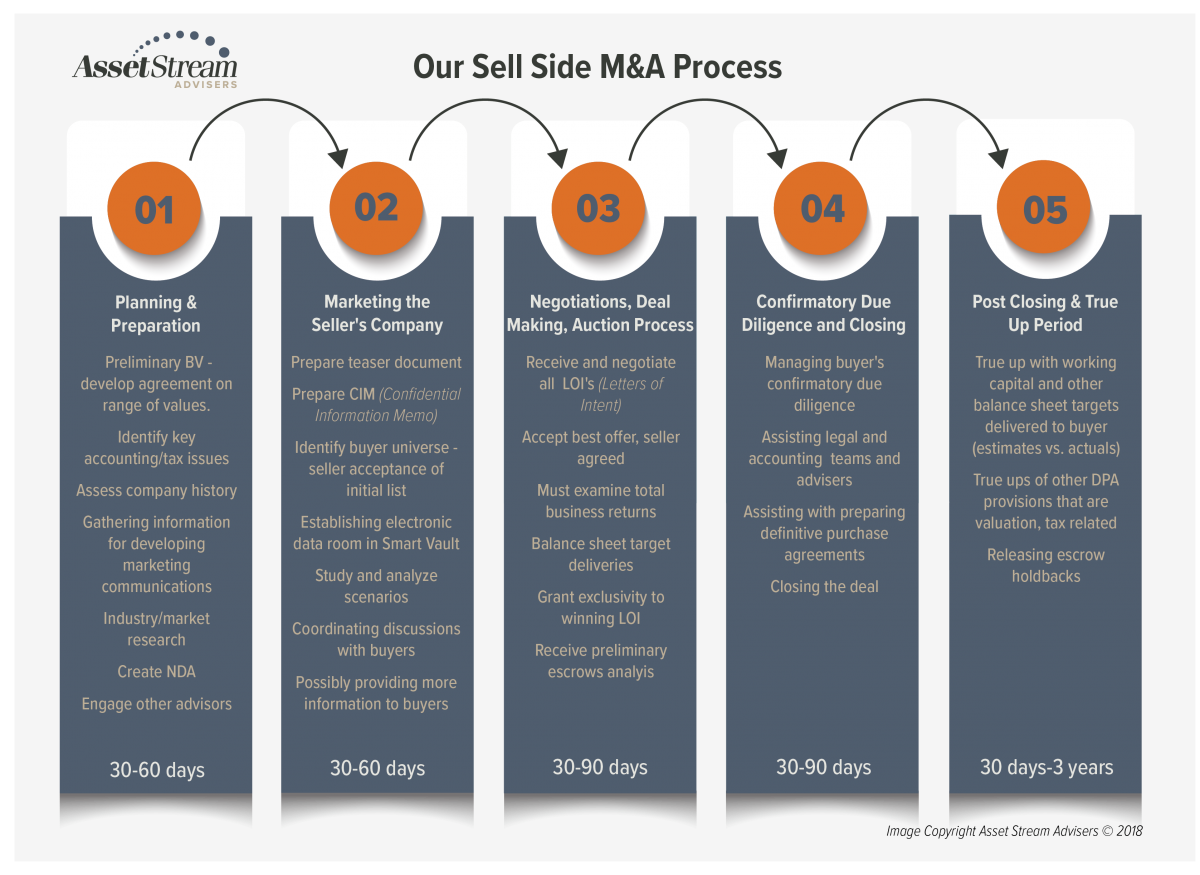

Sell-Side Representation:

There are multiple motivations for selling your company or your interests in the company. No matter the circumstances that have brought you here, we bring our knowledge from having been on both sides of the table to bear when we walk with you through the process.

Our process begins with a great deal of planning and preparation. We start by listening to your goals and value expectations. Once we have these nailed down, we determine a reasonable value range that we can expect the market to offer. We then go to work marketing your portfolio item and negotiating deals with an auction of potential buyers. As your investment banker, we handle all of the 100’s of complicated details than even small deals possess up to and beyond closing.

- Are your current business partnerships no longer functioning well or benefiting the corporation? Our goal is to identify the most advantageous solution, then negotiate new terms, exit agreements, new buy/sell arrangements, a merger, or an acquisition, depending on the situation.

- Are you the owner and you’re ready to exit the company? Some of the common situations we work with are those who want to pass the company on to the next generation. Owners wanting to exit and have the freedom to move on to the next endeavor. Founders who want to exit and have their retirement.

We offer investment banking services for all securities transactions through Burch & Co. The benefits of hiring an investment banker like Asset Stream for your sale are many. Investment bankers:

- Help the seller reach their monetary goals by assessing potential value under current and future market conditions, putting strategies for growth and a timely sale in place.

- Save the seller time and energy by planning, developing marketing materials, identifying the most optimal buyer universe, and acting as an “emotional firewall” between the seller and the buyer.

- Consider the seller’s post-sale relationship with their buyer, and structure the deal to protect seller holdbacks and earn-out provisions.

Investment bankers maximize owners total transaction value while also protecting higher protections against mitigating deal risks and ensure the survivability of the deal post-closing which is critical for both sides to achieve their goals.

Every business has potential. Our vision is to help you find it, identify it, foster it, grow it and turn it into profit!

Asset Stream P: (907)770-3772

Any testimonials and case studies presented do not guarantee future performance or success.